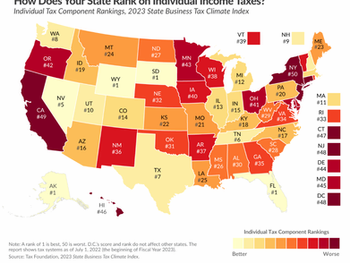

Oklahoma is again receiving low marks for its individual income tax competitiveness.

The Tax Foundation’s 2023 State Business Tax Climate Index ranked Oklahoma 31st in the nation when it comes to individual income tax competitiveness.

Oklahoma has languished in the bottom half of the Tax Climate Index for years, ranking 32nd in 2020, 31st in 2021 and 30th in 2022.

Oklahoma’s individual income tax has six income tax brackets ranging from 0.5 percent to 4.75 percent for top earners. The 4.75 percent rate kicks in at a $7,000 annual income.

All Oklahomans – and by some estimates, more than 95 percent of businesses in the state – pay the individual income tax. The income tax’s standard deduction is $6,350 for single filers and $12,200 for joint filers. The tax also has a marriage penalty because the top bracket does not double for joint filers.

An undesirable individual income tax rate can hurt a state’s ability to attract successful companies and talented workers.

Tax Foundation analysts say that a state must either simplify its individual income tax brackets into one low, flat rate or eliminate it all together to attract the best and brightest in the business world. Click here for Tax Foundation’s full report.