Business Leaders Optimistic, Workforce Top Concern

OKLAHOMA CITY (June 12, 2023) – Oklahoma business leaders are feeling optimistic about Oklahoma’s business and economic future, but they remain concerned about Oklahoma’s workforce availability. The continued concern for workforce was a key finding of the 2023 Oklahoma Business Leaders Poll, an invaluable resource that provides timely and comprehensive insight into the thoughts and […]

Oklahoma’s Missed Opportunity on Tax Reform

When it comes to tax reform, standing still means falling behind. As other states take advantage of their flush budget pictures to race toward pro-growth, economically competitive tax reform, Oklahoma’s legislature failed to advance significant tax reform during the regular legislative session, which just concluded. When we started this legislative session, hopes for meaningful tax […]

Oklahoma Workforce Commission Bill Back in Motion

After a brief conference committee detour, the bill that creates an Oklahoma Workforce Commission is back on track. Senate Bill 621 returned to the Oklahoma Senate and was approved with a 34-10 vote on Wednesday. The bill, written by Sen. Adam Pugh, R-Edmond, and Rep. Brian Hill, R-Mustang, is a key piece in the comprehensive […]

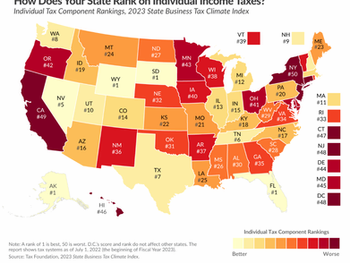

Oklahoma Still Ranks Low on Individual Income Tax Competitiveness

Oklahoma is again receiving low marks for its individual income tax competitiveness. The Tax Foundation’s 2023 State Business Tax Climate Index ranked Oklahoma 31st in the nation when it comes to individual income tax competitiveness. Oklahoma has languished in the bottom half of the Tax Climate Index for years, ranking 32nd in 2020, 31st in […]

Legal Lunch Box: Unionization

Adam Childers, president and CEO at Crowe & Dunlevy, is our featured presenter for the June 12th Legal Lunchbox. Childers will discuss what it means to be a right-to-work state, as well as employee and employer rights when it comes to union-forming efforts in Oklahoma. Register

Legal Lunch Box: Severance Agreements

Nathan L. Whatley is our special guest for the Legal Lunch Box on May 15. Whatley, a shareholder and practice group leader for McAfee & Taft, will discuss a recent National Labor Relations Board ruling on severance agreements between employers and employees, and how that ruling will impact Oklahoma businesses. Register

RIED rates SB 621 as Pro-Growth

RIED supports efforts that make a transformational impact on Oklahoma’s workforce. Currently in Oklahoma, there are numerous entities with some hand in Oklahoma’s workforce development. But there is no cross coordination of programs. There is no overarching plan for development for future needs. There is no single owner. The siloed thinking in workforce development creates […]

Bill Aims to Simplify Income Tax in Oklahoma

You’ve crunched the numbers and rounded up the receipts. The deadline to file those pesky income taxes has arrived. Oklahoma’s income tax is unnecessarily complicated. Because of our graduated, six-bracket income tax, each segment of your income is taxed at a different rate. Calculating the total amount owed requires a multi-step math problem or a […]

RIED rates HB 1590 as Anti-Growth

RIED opposes any permanent increase in taxes or fees to pay for a one-time revenue need, in this case an upgrade to 911 infrastructure. HB 1590 by Rep. Grego and Sen. Murdock imposes a 67% tax hike on the on all telephone lines in the state (including mobile phones), raising the 911 service fee from […]

RIED Updates Legislative Session Analysis

The Research Institute for Economic Development (RIED) updated analysis of legislation being considered this session. RIED is concerned about bills that impact economic growth, scoring legislator votes at the end of session. RIED added a bill that is anti-growth, HB 1590. The bill imposes a long-term 50-cent per phone line fee for 911 operations as […]